2020 Housing Boom

Posted by Kerri Whipple on Tuesday, November 17th, 2020 at 12:37pm.

Why the Housing Boom is Nowhere Close To Being Over

by James Miller, MBA

by James Miller, MBA

The housing market is totally out of balance… but not in the way you might expect. Considering that we’re in the middle of a global pandemic and an economic recession, you’d think any market imbalance would be a bad thing. But that’s not the case in housing. We’ve seen the U.S. housing market boom for the last decade. And what’s happening today tells me the boom can continue from here.

You see, the market can only fix this problem one way… supply and demand must tip back into balance. When supply is thin and there aren’t enough homes for buyers on the market, prices rise. When supply floods the market, prices will fall as buyers have more options.

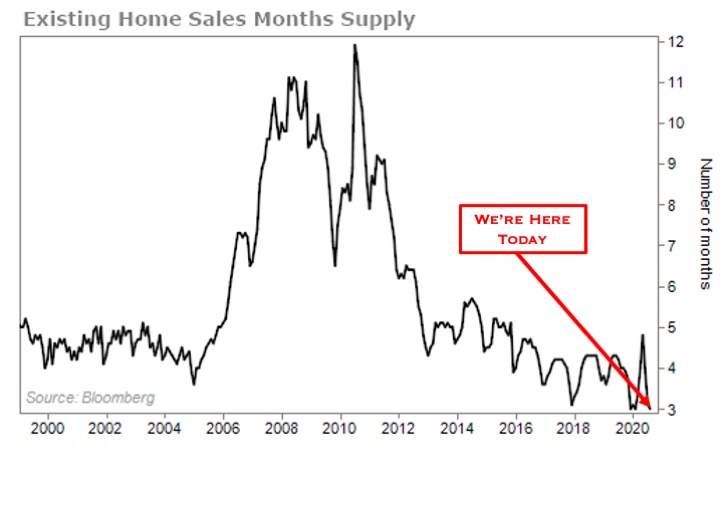

Today, existing home supply in the U.S. ties for the lowest it has been in more than 20 years. And that means the housing boom has much more upside ahead.

Let me explain…

When it comes to housing, it’s always about supply and demand. After a decade of booming prices, you’d expect supply to be high to meet increased prices. But that’s not what’s happening now. Existing home supply shows it…

This measure is an easy way to gauge if there are too many or too few homes on the market. And one way to see this is by tracking how long it would take to sell the current homes on the market.

The less time it takes to deplete the inventory, the tighter the supply. And when supply is tight, it’s a positive sign for prices going forward.

Right now, it would take just three months to sell all of the existing homes in the U.S. That ties for the lowest on record. Take a look…

There aren’t enough houses on the market to keep up with demand. It’s really that simple. And as long as that’s the case, home prices will continue to rise.

You can also see in the above chart that after record-low supply in early 2005, the number of houses on the market started to rise.

Existing inventory was at multiyear lows. And buyers didn’t have many options to choose from.

Then, inventory started to rise dramatically. It went from less than four months to nearly 11 months by the height of the housing bust in 2008.

When inventory starts to spike like it did back in 2006 and 2007, it will be a warning sign that lower home prices are on the way. More importantly, that’s not happening yet.

We are still seeing record-low inventory that’s failing to keep up with demand. That means one thing… Higher home prices are likely from here.

This is a big reason why I’ve been bullish on housing for years to come. And it tells me that while this boom is nearly a decade in, we shouldn’t expect it to end anytime soon.